At Via ID, we closely watch the micro-mobility market, globally. Micro-mobility operators benefit from 2 strong macro-trends: environmental awareness and micro-mobility boom.

In short, micro-mobility operators were at the cornerstone of 3 trends in 2021:

- Increased regulations requirements, especially about safety

- Market consolidation

- Increased competition when it comes to embedded technology in hardware

Lots of great articles are already talking about it, predicting where 2022 could bring us in micro-mobility. Those players needed huge amounts of cash to fulfill their ambition, and mostly because the micro-mobility market is an operational game that requires big investments.

We already analyzed this segment in the report State of European Mobility Startups 2021, but I’m offering you a deep-dive into all the venture capital investments in those players that happened in 2021, month by month.

We hope you’ll find this note insightful!

Vincent

Key takeaways:

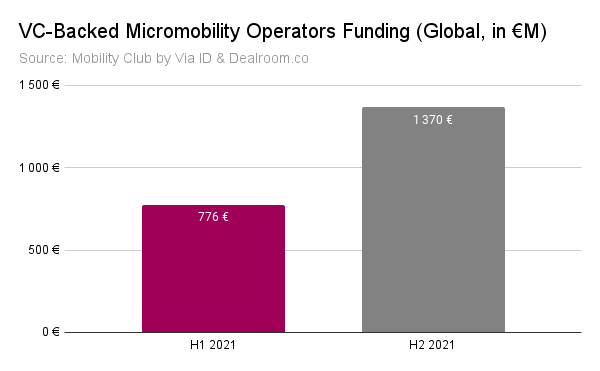

- €2.1B total invested in micro-mobility operators globally

- First micro-mobility operators went public

- USA remains 1st country in terms of deals, followed by Germany

2021 Micro-mobility funding

€2.1B were invested in micro-mobility operators in 2021. Major fundings happened in H2’21, with 5 deals above €100M (Bolt, Voi, Tier, Lime, Hello TransTech).