As Mobivia’s (Norauto, Midas, ATU…) impact investment fund, Via ID finances sustainable mobility startups.

Via ID is a committed investor that promotes diversity by supporting initiatives like Sista and French Tech Tremplin. Since 2010, Via ID has been supporting innovative entrepreneurs who want to transform the mobility of tomorrow.

Via ID supports entrepreneurs who share its vision and values, so that together we can create disruptive solutions for a better world.

What is Via ID’s investment thesis?

- Maturity of startups: early stage (Seed, Series A)

- Position: minority – lead or co-lead

- Ticket size: from €500,000 to €5 million

- Geographic area: Europe

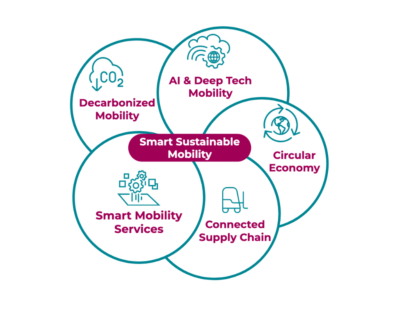

- Thesis: B2B sustainable mobility

The 3 pillars of

Via ID’s investment policy

Impact

1. Supporting Decarbonization and an Equitable Future

Via ID supports the decarbonization of the economy and works towards a sustainable future, considering environmental, social, and economic factors. Via ID’s commitment is demonstrated by actively supporting companies that aim to reduce their carbon footprint and promote sustainable practices.

2. A Proprietary Extra-Financial Analysis Tool

Via ID has developed a proprietary extra-financial analysis tool that integrates environmental, social, and governance (ESG) considerations from the early stages of the investment process. This tool helps to:

- Exclude potential investments that have a significantly negative impact on environmental or social objectives.

- Quantify the potential impact concerning environmental and social issues.

- Identify areas for impact improvement, develop an action plan, and monitor progress to help entrepreneurs implement sustainable actions.

3. Contributing to the United Nations Sustainable Development Goals (SDGs)

Via ID finances companies and projects that contribute to achieving the United Nations Sustainable Development Goals. Via ID has targeted four priority SDGs:

- SDG 3: Good Health and Well-Being

- SDG 10: Reduced Inequalities

- SDG 12: Responsible Consumption and Production

- SDG 13: Climate Action

People

1. Emphasizing the Human Dimension

Via ID believes that a company’s performance largely depends on the talents and skills of its teams. Via ID thinks that, to best support a founding team, it must know it well. Therefore, Via ID integrates a human dimension at every stage of our decision-making process:

- Initial Team Assessment: During the investment file review, Via ID introduces a Human Resources (HR) component to deeply evaluate the founding teams and key profiles of the companies analyzed. This assessment includes thorough interviews and the use of skills and personality assessment tools.

- Group Dynamics Analysis: Via ID examines group dynamics and corporate culture to understand how teams work together. Special attention is given to the complementarity of skills, diversity of experiences, and the capacity for collaboration.

2. People at the center of concerns

Via ID believes that success comes from the people who make up the company. Via ID pays close attention to the founding team and key profiles to identify individual and collective strengths, as well as potential risk areas. This allows it to ensure it leverages everyone’s strengths, makes specific recommendations to optimize human performance, and prevents potential conflicts.

3. Anticipating Human Risks

Via ID strives to identify and anticipate human risks to ensure harmony among founders and foster a positive working environment within teams.

Innovation

1. Alongside visionary entrepreneurs

Via ID aims to build the future of mobility alongside entrepreneurs who envision it. Convinced that mobility is undergoing significant changes, Via ID positions itself at the center of this evolution to finance it and be an active participant.

2. Expertise and Legitimacy

Via ID’s expertise in the mobility sector, its ecosystem, and its network provides Via ID with the legitimacy necessary to be at the heart of these changes. Via ID supports breakthrough technological projects and innovations in mobility, which are essential to transforming this vision into reality.

Via ID is determined to develop ambitious and responsible entrepreneurship, capable of anticipating the future challenges of sustainable mobility. Via ID supports entrepreneurs who share its vision and values, working together to create disruptive solutions for a better world.

The entrepreneurs we support are at different stages of maturity of their project, but always with the ambition to become international leaders in their field. With kindness, requirement and passion, we are at their side to put them in the best conditions for success.

A unique system

Via ID provides financial support for the development of sustainable mobility startups right from the seed stage.

The Via ID team, made up of around twenty people, provides startups with day-to-day support for their operational challenges (marketing, HR, finance, legal, sales, etc.).

At the heart of the mobility ecosystem, Via ID promotes synergies between startups, large companies, territories, investors and Mobivia

With its offices in Paris, Lille and Munich, Via ID supports startups in their European and International development