VC Associate

The Corporate Sustainability Reporting Directive (CSRD) as a key driver for more innovation in the mobility sector

“If you can’t measure it, you can’t improve it”, this quote is attributed to Peter Drucker. In the past years, a large amount of VC money has been invested into SaaS B2B startups helping to measure and optimize business and operations metrics. Now, more and more funding (close to €1B since 2021) is engaging in sectors with significant potential to tackle the climate crisis, since it allows us to understand where emissions are coming from, and how to mitigate them: carbon tracking & offset.

This trend is driven by increasing (and positive) pressure from consumers, investors, shareholders, and more importantly, regulation. Recently, the Corporate Sustainability Reporting Directive went into effect (January 2024), and its potential influence could be substantial, and drive greater innovation to decarbonize mobility.

We’re seeing a growing need from corporates and enterprises to meet the CSDR objectives. Facing increased pressure from investors and consumers, these players must enhance their ability to precisely measure transport-related emissions, which cannot be seriously tackled by generic carbon tracking & offset solutions. Here’s why.

The context

The Corporate Sustainability Reporting Directive (CSRD) stands as a pivotal milestone in the global journey towards sustainability. Evolving from the Non-Financial Reporting Directive (NFRD), this European regulation introduces heightened transparency and standardization in sustainability reporting practices.

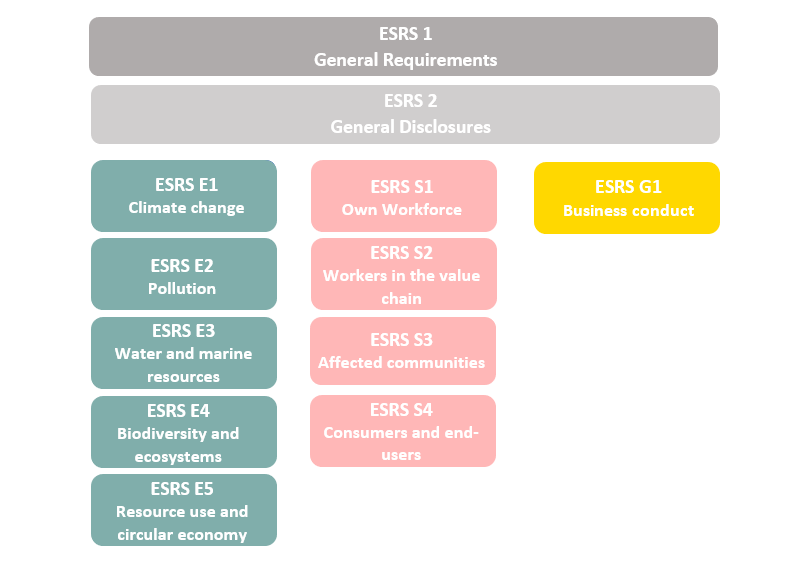

While we’ll focus here on the environmental side of the CSRD (which encompasses Environmental, Social, and Governance criteria, or ESG), it’s important to share a bit of context.

From January 1, 2024, listed companies in the EU with +500 employees must comply with this new regulation. As of January 1, 2025, unlisted companies in the EU with at least 2 of the following criteria must be compliant:

- €40M net sales

- €20M on balance sheet

- 250 employees

As Sifted reminds us, “some 50K incorporated, listed or doing business in the EU will be required to report on their sustainability”, we’re talking about a considerable regulatory impact here. The first reports are expected in 2025 and will have the same importance as financial reporting.

The CSRD is about quantitative reporting. The market expects CSRD KPIs will be used for company valuation. As highlighted by a recent survey conducted by PwC, “CSRD reports will equip investors with more consistent, more comparable data. We expect many will use this data to value companies, rewarding those that articulate a compelling narrative about how they will compete amid sustainability-driven market forces.” The pressure to comply is huge. So despite market conditions, it won’t go away.

The scope of the Corporate Sustainability Reporting Directive is extensive, as it aims to enhance and standardize sustainability reporting practices across the European Union (EU). The CSRD introduces several key changes to broaden the reach and impact of sustainability reporting.

Source: Greenscope

The ESRS 1

It’s important to note that sector-specific ESRS (set 2) is expected by 2026.

Not only does the CSDR impact corporates and enterprises, but their suppliers too: companies are responsible for reporting on their value chains (upstream and downstream). This is one of the biggest impacts of the CSRD.

Here are some aspects that highlight the scope of the CSRD:

- The CSRD has extended applicability (a wider range of businesses are submitted).

- Digital reporting is the rule, and the use of technology is encouraged.

- Reporting about the Value Chain (not only the main activities), but also the upstream and downstream parts of the activity

- Companies will report on topics that are material to their business and stakeholders (the so-called materiality concept, or fight against greenwashing).

- The extra-financial criteria should be considered for investment decisions.

- Connectivity between financial and extra-financial reporting

The European Financial Reporting Advisory Group (EFRAG) released in 2022 its first set of European Sustainability Reporting Standards (ESRS). It’s a framework for what metrics need to be reported by companies, and how they should be reported to comply with the CSRD.

What does it mean in terms of carbon accounting?

Companies must enhance their carbon accounting capabilities (measuring the emissions) so they can better (and accurately) understand how to reduce emissions, and eventually share better results in their reporting on the environmental side (based on their emissions, but also the ones coming from their value chains).

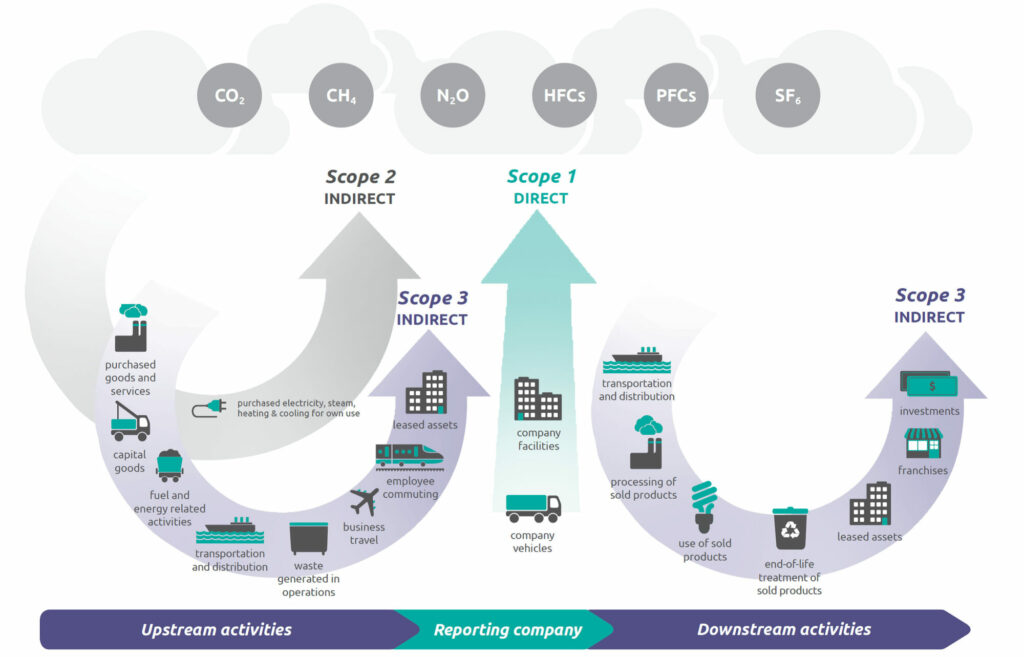

There are 3 main emissions scopes:

- Scope 1: Direct emissions from sources owned or controlled by a reporting company

- Scope 2: Indirect emissions generated from purchased energy—including electricity, steam, heating, and cooling

- Scope 3: All the carbon emissions indirectly generated by a business: business travel, employee commutes, waste disposal, purchased goods and services, the goods produced, end-of-life disposal of products, transportation, distribution, and more. It’s 70% of the average corporate value chain’s total emissions. Bloomberg analyzed 15K companies and found that only 20% of them disclosed their scope 3 emissions for the 2020 fiscal year.

The CSRD requires measuring the 3 scopes (remember the value chains), the third being the most challenging.

Source: GHG Protocol

The different emissions scope

The market recognizes 3 main carbon accounting methodologies, all have pros and cons:

- Spend-based methodology: calculates carbon emissions by considering the financial value of a purchased good or service, and multiplying it by an emission factor

- Activity-based methodology: gathering data across the organization’s value chain

- Hybrid methodology: a combination of both

We’re witnessing the emergence of private standards for carbon accounting: Greenhouse Gas Protocol, PCAF, SASB, and GRI, but the market is still looking for a universal and proven standard. So “standardization” is still an ongoing process, and we’re waiting for sector-specific ESRS. The GHG Protocol, which is the most used system for carbon accounting, could even “guestimate upstream and downstream emissions”.

The CSRD will have a strong impact on mobility, accentuating the urgent need to decarbonize how people and goods are moving, given that transportation accounts for around 25% of the EU’s greenhouse gas emissions (GHG), while the vast majority of these emissions fall into the Scope 3. However, Scope 3 is the most difficult one to be measured, because of the huge variety of data, and more importantly, the lack of access to granular and accurate data.

If companies fail to meet the CSDR objectives, they can be subject to penalties, but more importantly, in the future, their valuation could be affected. Indeed, bad performance in CSRD reporting could lead to a lower valuation (investors are now increasingly looking to invest in companies with clear and proven sustainability strategies), bad communication, and potentially even an investor boycott.

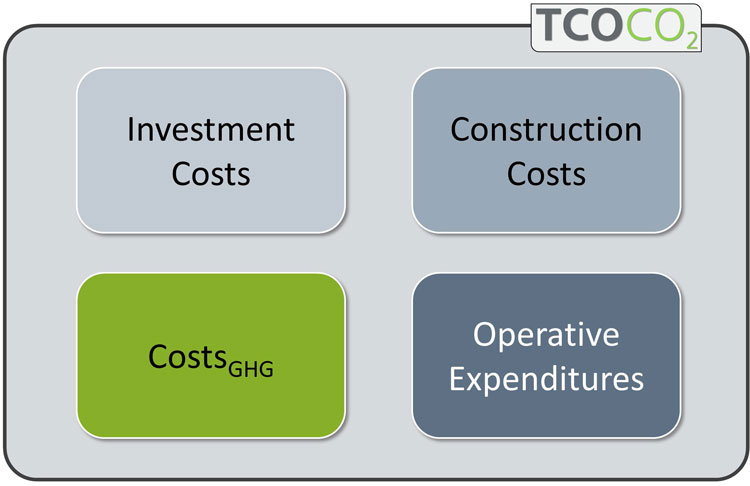

Source: Global Railway Review

The TCO CO² from the ecological tendering system of ÖBB

You get it, this regulation can be a game-changer. Stronger carbon accounting and reduction solutions are needed. Most tenders already include environmental and carbon criteria.

The impact on mobility

This regulation will have a major business impact on companies with mobility operations or mobility being the core business, given the share of transport in the EU’s GHG mix. Some corporate fleets account for more than 90% of carbon emissions. Companies must reassess and realign their operational strategies with clear and measurable carbon reduction objectives.

Some concrete examples of the impact of the CSRD Directive on mobility segments in the B2B space :

- Commercial fleet management: increased sustainability reporting, with detailed information on carbon emissions and overall environmental impact, and a faster shift to EVs

- Employee and corporate mobility: fleet managers must develop effective strategies to make the home-work trips more sustainable, switch to cleaner modes of mobility, as well as their business travels (arbitrage between remote and in-person meetings)

- Rail: more investments in green infrastructures (electrified tracks and energy-efficient technologies), more sustainable procurement strategies

- Aircraft: more effective emissions reduction strategies (carbon offset initiatives, fuel-efficient aircraft…) and more technological innovation (improved air traffic management systems, better engines…)

- Maritime: greater adoption of alternative fuels (biofuel blends, methanol, liquefied natural gas…), increased investments in clean ship design, increased activity in clean urban logistics…

- Logistics & supply chain: increased traceability and accountability throughout the entire supply chain, more energy-efficient operations, green logistics initiatives

The increased need for mobility-focused carbon tracking & offset solutions

Startups specializing in emission measurement and reduction technologies become instrumental in helping the companies subject to the CSDR (directly, or indirectly) meet and exceed regulatory standards.

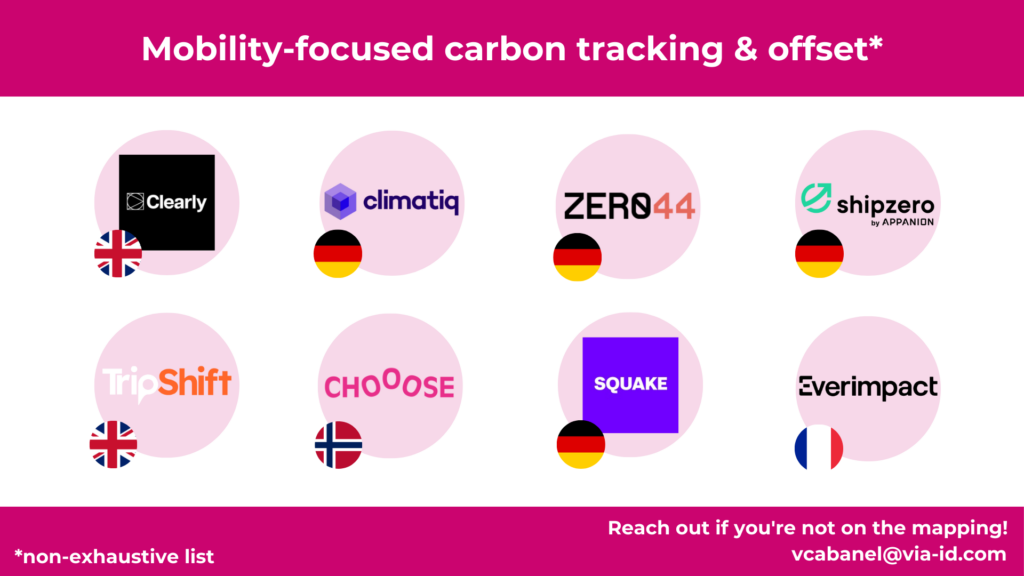

VCs embraced that opportunity. According to our latest report, the State of European Mobility Startups 2023, around $1B has been invested in carbon tracking & offset startups in Europe since 2021.

It’s worth mentioning that only 2% of this funding went to mobility-focused solutions. The transportation sector needs more accurate and mobility-specific data, such as trip planning, fleet type, weather, energy consumption, etc.

Regular carbon accounting frameworks often lack specificity when it comes to transportation-related emissions. Moreover, they can’t access specific data that is accurate and granular enough to measure these emissions.

Advances in technology, such as IoT (and telematics), AI, and data analytics, enable more accurate and real-time measurements of carbon emissions. Mobility startups leverage these technologies to develop innovative solutions for monitoring emissions across various modes of transportation, offering data-driven insights for effective reduction strategies (modes of transport used, distances traveled, fuel consumption, driving behaviors, traffic management…). Mobility-focused solutions enable customized emission factors, tailored to different modes of transport and geographic regions, hence more precision emission calculations.

Some examples of carbon tracking & offset startups with a mobility focus include:

While the CSRD is already effective, companies have until 2025 to comply with the regulation. However, we think that these players are already anticipating it, because of increased pressure from the investors, the politics, the consumers, and the society in general to decarbonize their operations.

We think the logistics companies and companies heavily relying on commercial fleets will be the first movers.

We think successful mobility startups addressing the CSRD challenges will have the following:

The scope 3 conundrum requires more innovation in collecting (in a structured way), gathering, processing, and combining mobility-related supply chain (necessary and qualitative) data to generate the needed insights for all players. Successful startups will be able to collect granular and relevant data on scope 3, using multiple and different data sources, but also processing it to deliver results with outstanding accuracy. Solid carbon accounting methodology, using very relevant emissions factors is mandatory to address scope 3.

Technology-wise, the main differentiation lies in the ability of mobility founders to develop solutions and products tailored for scope 3 mobility emissions, set a true standard for mobility-focused carbon accounting, and certify the data. More and more scrutiny will come into how scope 3 is monitored, so strong technology and methodology for data analysis and insights delivery is key. Defensibility will also come from the product’s ability to be plugged into existing IT infrastructures: being able to be plugged thanks to API into existing generic carbon accounting tools (if any) and/or existing reporting tools will be interesting.

Founders must have a deep understanding of corporates and enterprises’ needs, a strong ability to navigate a complex – and quite lengthy – sales cycle, and hence a solid go-to-market strategy. More and more tenders not only include business-related KPIs, but also carbon emissions ones. Because of their greater visibility on the market, corporations and enterprises will be the first to look for better mobility emissions measurement and reduction solutions. Tenders not only include business-related KPIs, but also carbon emissions ones. The right balance must be found between direct sales, integration with existing tools, and indirect sales.

Improved decision-making capabilities, helping corporates and enterprises make the right choice regarding mobility-related emissions while maximizing the business value of their operations and activity. Meeting both environmental targets (addressing the mobility scope 3 main drivers) and business ones can be conflicting. Hence, a strong ability to support its clients in that matter is another differentiation factor. Great analytics capabilities help to make the right arbitrage between value creation and carbon emissions reduction, the solutions must be developed with a clear focus on the ROI.

Founders must be excellent at seizing the right time-to-market to address players with different urgency feelings, while all of them will eventually need a mobility-focused solution to be able to certify the accuracy of their reporting. The CSRD roll-out is ongoing, but not all players are ready: momentum will be key to being successful. This is why we think successful startups will be able to navigate the complex market landscape, and quickly monetize their solutions, so they’re in the right position to address the majority of “late-movers” players.

If you’re building a startup looking like this, or want to discuss that exciting topic, feel free to reach out!