Via ID and Dealroom.co proudly present the latest edition of their report, delving into the intricate details of the European mobility startup fundraising scene – “State of European Mobility Startups 2023.”

In the backdrop of a globally downturned VC market in 2023, characterized by challenges like restricted access to funding, diminished valuations, and heightened interest rates, the resilience of the European mobility startup ecosystem remains a beacon of hope. In the wake of the 2021 funding bubble, where European mobility startups raised $12 billion in 2022 (compared to $14 billion in 2021), the industry has demonstrated its robustness, anchored by two primary pillars: the flourishing e-mobility sector and sustained early-stage funding.

The Funding Landscape for European Mobility Startups in 2023

Venture Capital and M&A

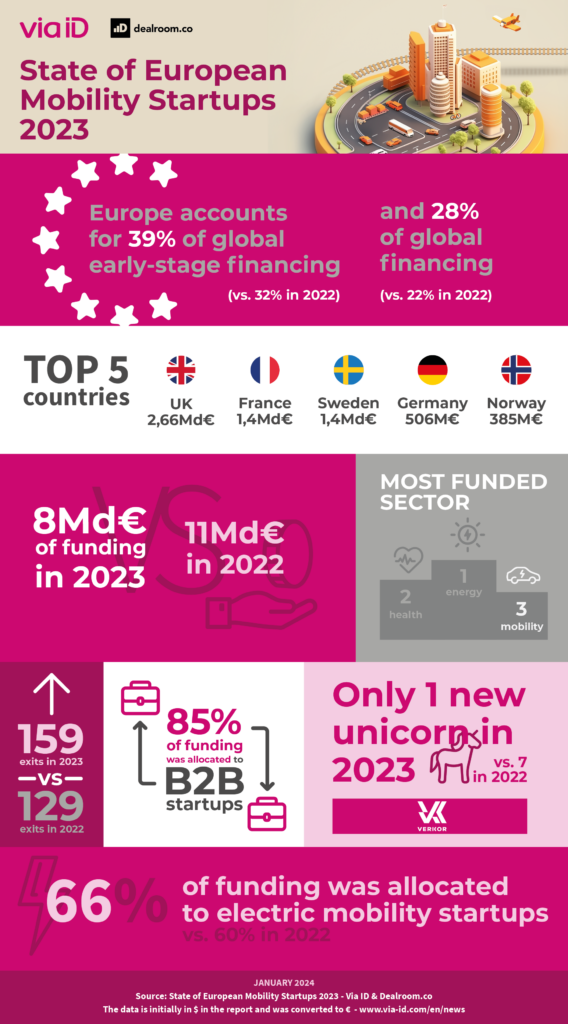

In 2023, European mobility startups secured $9 billion in funding, marking a 26% decrease from 2022. Despite this notable dip, funding levels surpass pre-pandemic norms, with the mobility sector ranking third among funded industries in Europe. Notably, only one unicorn emerged in 2023—Verkor.

B2B startups dominated the funding landscape, attracting 85% of investments, signifying a shift away from B2C ventures. Corporate investors maintained their engagement, contributing $2.8 billion across 85 deals, showcasing sustained interest in mobility startups.While funding dynamics slowed, M&As experienced a surge, witnessing increased consolidation, particularly in the logistics sector, with 159 exits recorded compared to 127 the previous year.

Valuations in the European Mobility Landscape in partnership with Clipperton

The average valuation declined to $62 million from $99 million in 2022. Although the Seed stage funding exhibited resilience, over 50% of funding rounds occurred at valuations below $5 million. Intriguingly, the median valuation saw an increase.

Examining business models, marketplaces and manufacturing faced a decline, whereas SaaS companies observed a slight uptick in their valuations.

Trends Analysis

E-mobility companies took the spotlight in 2023, securing an all-time high funding share. Infrastructure-related startups, EV battery, and EV charging startups were key contributors, aligning with trends observed in 2022. Autonomous and sensor startups exhibited resilience throughout the year.

A rising trend emerged in carbon tracking & offset, with almost $1 billion invested in startups addressing carbon emissions challenges. While representing only 2% of mobility funding, focused solutions are expected to gain traction.

Geographic Insights

In a significant development, Europe narrowed the gap with the US, nearly matching funding levels for the first time, demonstrating superior resilience (with the US experiencing a 50% drop). Europe increased its global funding share and retained its top position for early-stage funding, signaling positive prospects.

Only a few countries – such as the UK, France, and Norway – showed an increase in funding.

Want to Learn More? Download the Report!

Seize this opportunity to gain in-depth insights into the European mobility landscape. Fill out the form to access the full report and navigate the dynamic world of mobility startups in 2023!

- How much funding did European mobility startups receive in 2023, and how does it stack up against investment trends in other industries and countries?

- What were the most funded business models in 2023, and how does this compare to funding patterns in previous years?

- In 2023, which segment witnessed the highest level of consolidation, and who were the most active acquirers in that sector?

And more!

Watch the official release webinar replay

Any questions?